Travelers may use int’l cards in RCBC mobile ATMs starting July

Travelers may use int’l cards in RCBC mobile ATMs starting July

By Joyce Ann L. Rocamora

Share

X (formerly Twitter) Viber Email

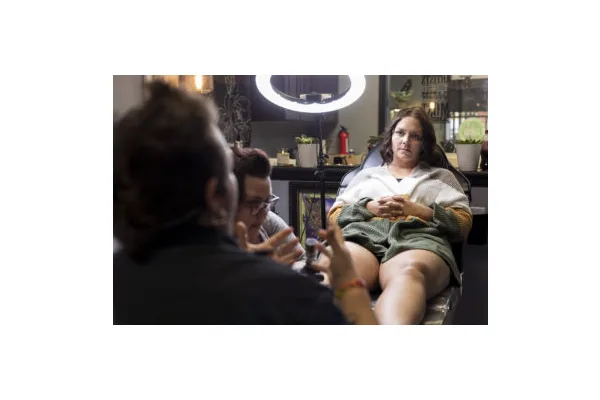

FINANCIAL BOOST. Rizal Commercial Banking Corporation executive vice president and chief innovation and inclusion officer Lito Villanueva (right) demonstrates how ATM Go works at a presentation in Makati City on Tuesday (May 6, 2025). The bank has partnered with the Department of Tourism to expand its services of ensuring cash flow to the public through the use of mobile point-of-sale terminals that allow people, such as tourists, to withdraw funds through the bank’s partner establishments. (PNA photo by Joyce Rocamora)

MANILA – Tourists may soon use their international cards to withdraw cash from Rizal Commercial Banking Corporation's (RCBC) mobile automated teller machine (ATM) across the Philippines.

The mobile “ATM Go” is an innovation by RCBC that allows manual cash withdrawals, deposits and transfers through merchants, majority of which are sari-sari (retail) stores in far-flung areas where regular ATMs are often hard to find.

It employs mobile point-of-sale (POS) terminals that merchant partners/agents use, with the amount of withdrawal dependent on the capacity of the store.

On Tuesday, RCBC deputy chief executive officer Reginaldo Anthony Cariaso and executive vice president and chief innovation and inclusion officer Lito Villanueva, and Department of Tourism (DOT) Secretary Christina Frasco and Undersecretary Shahlimar Tamano signed a memorandum of understanding (MOU) to expand financial services to more tourist sites.

To date, ATM Go caters to Philippine-issued debit and prepaid cards but starting July this year, it will also cater to foreign-issued MasterCard/Visa cards, Villanueva said.

By the end of the year, Villanueva said they target to add 3,000 more terminals in key travel locations, especially those with high concentration of foreign tourists and lacks banking services.

“For example, in island barangays (villages), walang ATM doon or bangko (there are no ATMs or banks there), then we will deploy those terminals there. We will make sure that the deployment of ATM Go terminals would be very strategic and targeted,” Villanueva said.

Frasco said the partnership provides tourists with easy access to banking services while financially empowering small tourism businesses and workers.

“Sari-sari store owners, habal-habal (motorcycle taxi) drivers, homestay operators, tour operators, souvenir makers, dive guides, dive boat operators, boatmen, street food vendors, (and) cultural performers, they are the life blood of the tourism value chain, yet, many of them operate in places where basic banking is few and far between," she added.

Among the key tourism destinations RCBC is identifying for the deployment of more terminals are Palawan, Siargao in Surigao del Norte, and Cebu as well as the DOT’s Tourist Rest Areas. (PNA)

NAIA 'green lane' scanning temporarily suspended to avoid long lines

August 14, 2025 8:36 pm